What Does This Mean for You?

If your business' e-invoice is:

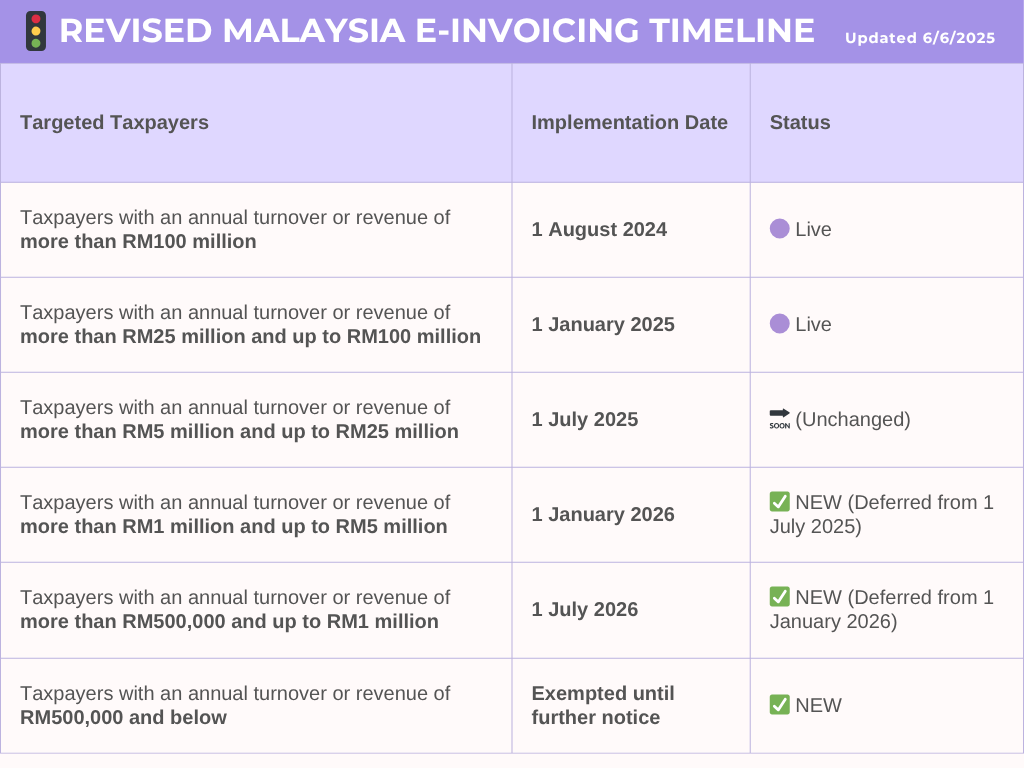

Already Live (annual revenue above RM25 million):

- You should already be issuing e-Invoices through MyInvois or an API integration.

Next in Line (RM5 Mil – RM25 Mil):

- Your deadline remains 1 July 2025. It's time to actively test and validate your e-Invoicing workflow.

SMEs (RM1 Mil – RM5 Mil):

- You now have until 1 January 2026 to prepare – a 6-month extension.

Microbusinesses (RM500K – RM1 Mil):

- You’ve been given an extension to 1 July 2026.

RM500K and below:

- You're exempted until further notice, but voluntary adoption is encouraged.

How Phase 3 Businesses Can Start Preparing for E-Invoicing?

A smooth transition requires early planning and the right tools. Here’s a clear step-by-step guide to help you get ready:

1. Review Your Current Invoicing Setup

Ask your team:

- Can the current system integrate with MyInvois?

- Should the company generate e-invoices manually through the MyInvois Portal

For medium-sized businesses, system built-in e-invoice features or middleware integration is often the better choice to manage higher invoice volumes efficiently. Manual entry through the portal is more suited for smaller businesses with fewer invoices.

2. Select the Right E-Invoicing Method

Businesses have three main options for generating e-invoices. Choose the one that fits your setup and scale:

Option 1: Use an Integrated ERP or Accounting System

If you’re using an ERP or accounting software, check if it’s already integrated with LHDN’s MyInvois system. Some vendors (like iDCP ERP), offer built-in e-invoicing features that comply with LHDN’s requirements—making the process seamless.

Option 2: Integrate Through Middleware

If your current system isn’t e-invoicing ready, consider using a cost-effective middleware solution. Middleware platforms help connect your software (without needing to change existing software) to MyInvois without the need for complex development work, reducing the pressure on your IT team.

Option 3: Use the MyInvois Portal for Manual Entry

For businesses with a low volume of invoices, manual entry via the MyInvois Portal is a simple and cost-effective solution. This method is ideal for smaller companies that don’t need system integration.

3. Test Your Setup and Train Your Team

Before going live, use the MyInvois Sandbox to simulate real scenarios. This helps you catch errors early and understand the full workflow. Make sure your staff are trained on:

- How to create and submit e-invoices

- Responding to rejections or making corrections

- Handling QR codes and Unique Identification Numbers

How iDCP Can Help?

Whether you're a retailer, wholesaler, or distributor,

iDCP Cloud ERP system

makes e-Invoicing compliance easy:

✅ Seamless integration with MyInvois and PEPPOL (iDCP has dual accreditation of SP and PRSP from MDEC)

✅ Real-time sales and inventory syncing

✅ Support for B2B and B2C flows

✅ Effortless e-invoice creation at the point-of-sales and back-end processes

✅ Built-in dashboard to track e-Invoice status and errors

Ready to Start? We've Got You Covered

Let iDCP help you stay compliant with the latest LHDN requirements — without the stress.

📲

WhatsApp iDCP at 012-937 9260 to schedule a free consultation.